tax shield formula apv

1 The idea is to value the project as if it were all equity financed unleveraged and to then add the. May 4 2010 at 650 am.

Using Apv A Better Tool For Valuing Operations

Formula 19 is the most.

. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. Tax Shield Deduction x Tax Rate. I understood that part I just.

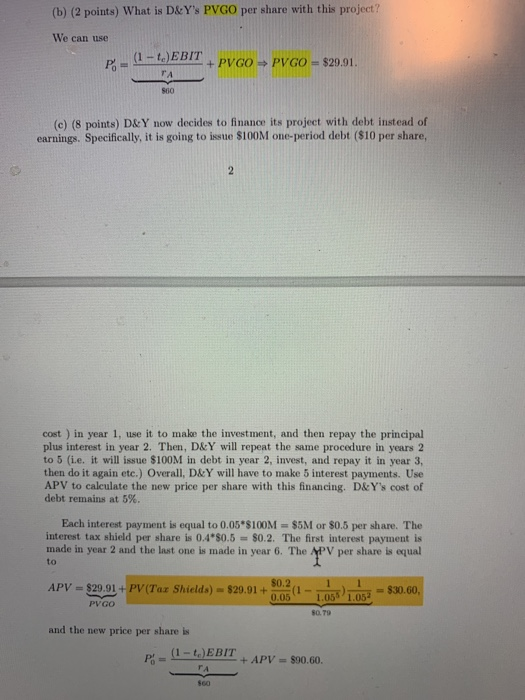

APV Calculation PV of Tax Shield - Free ACCA CIMA online courses from OpenTuition Free Notes Lectures Tests and Forums for ACCA and CIMA exams. The most common side effect to evaluate is the interest tax shield. Payment type payment ach credit tax reporting description type addendum due date frequency ist quarterly 04122 c 20th quarterly sales miscellaneou 04130 a ist miscellaneous 04132 c st-use sales use tax 04140 a sales energy-month 04150 e 20th monthly sales energy-qtrly 04155 a 20th quarterly sales non-energy-mh 04160 e 20th monthly.

How to Calculate APV Step-by-Step Since the additional financing benefits are taken into account the primary benefit of the APV approach is that the economic benefits stemming from. Present Value of Cash Flows formula and calculations. Adjusted present value APV is a valuation method introduced in 1974 by Stewart Myers.

The Difference Between Income Tax Expense. Pv cf cfr a mr - r100 - pc - 100 -. The effect of a tax shield can be determined using a formula.

Apv Construction LLC Address. The tax shield thereon. The Present Value of Tax Shield pv ts is.

500 F E Rodgers Blvd. June 23 2022 January 11 2021 by admin. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

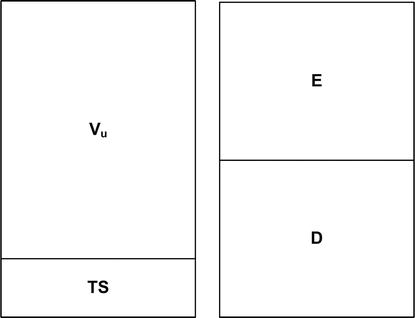

This is usually the deduction multiplied by the tax rate. Adjusted present value is a valuation method which segregates the impact of financing cash flows such as debt tax shield on a projects net present value by discounting. The adjusted present value APV approach portrays the value of a leveraged firm or project as the sum of NPV of the value of the firm or project like it is an unleveraged and side effect of.

Interest tax shields arise from the ability to deduct interest payments from earnings before taxation. How Can A Company Have A Profit After. The Adjusted Present Value apv is.

81633m x 30 tax rate x 72 1763m per annum. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. Use our bidding system to request a quote.

The adjusted present value APV analysis is similar to the DCF analysis except that the APV does not attempt to capture taxes and other financing effects in a WACC or adjusted discount.

Adjusted Present Value Apv The Strategic Cfo

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Adjusted Present Value Apv Awesomefintech Blog

Apv Method In Merger Valuation Youtube

Adjusted Present Value Notes Docx Adjusted Present Value Apv Definition By Marshall Hargrave Reviewed By Gordon Scott Updated Apr 24 2021 What Is Course Hero

Using Apv A Better Tool For Valuing Operations

Solved In Part C What Is The Formula Of Pv Tax Shields Chegg Com

Adjusted Present Value Apv Method Formula Example

Adjusted Present Value Apv Definition Capital Com

Pdf Equivalence Between The Fcf Method The Ccf Method And The Apv Approach

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Using Apv A Better Tool For Valuing Operations

Interest And Tax Shield In Wacc Part 2 Youtube

Apv Adjusted Present Value Overview Components Steps

Solved Question 8 Of 10 10 Points Which Of The Following In Chegg Com

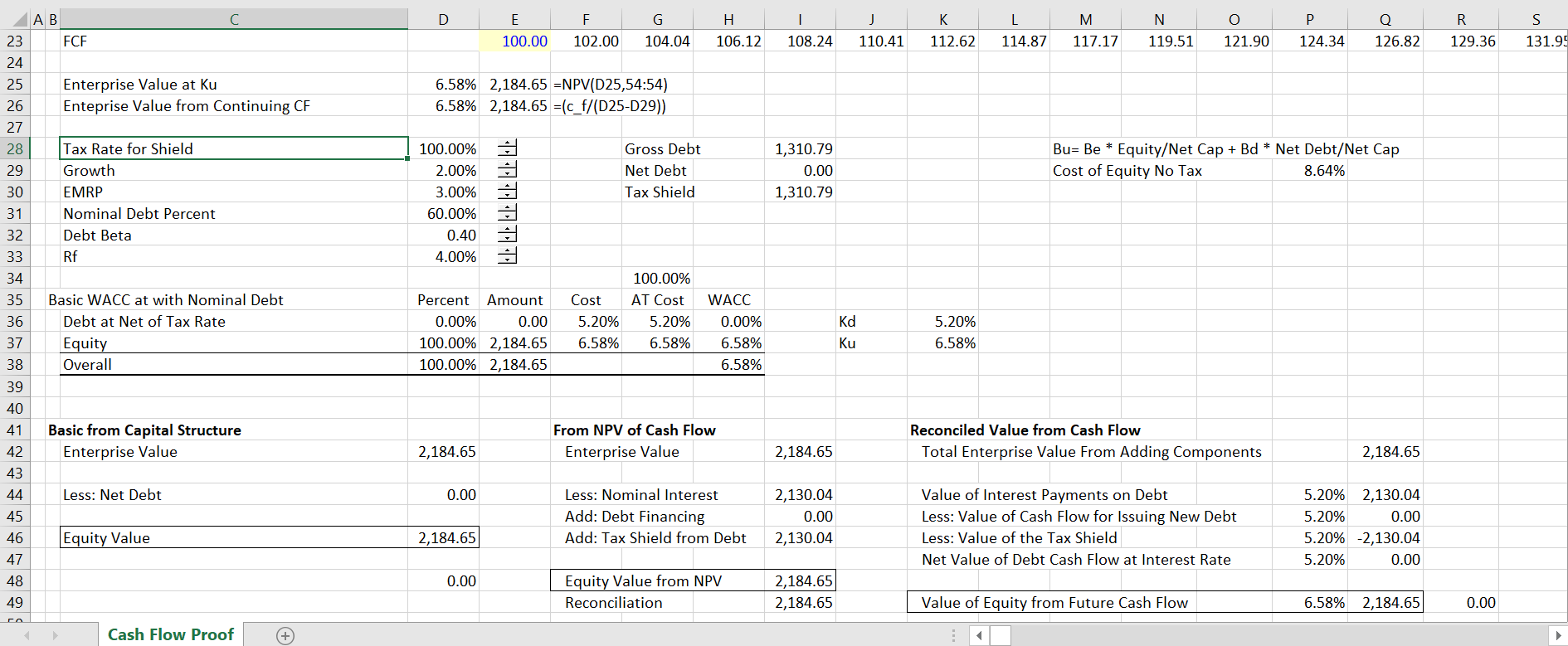

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

On The Equivalence Between The Apv And The Wacc Approach In A